- Property Tax Breakfast

- E3 Consulting Conferences 2025

-

Past Events

- RTPI South West - CPD Day

- ‘Developer Roundtable’ event at Silvermere Golf & Leisure, Cobham, Surrey

- BPA Post Autumn Budget Panel Seminar

- Property Tax Roundtable - CIL, LRTR & Budget Update

- December Roundtable - Community Infrastructure Levy & Land Remediation Tax Relief

- November Roundtable - Community Infrastructure Levy & Land Remediation Tax Relief

- Commercial Property purchases – is tax relief on your radar?

- A kaleidoscope of property tax opportunities

- Webinar: CIL Panel Discussion

- Minerals conference left no stone unturned

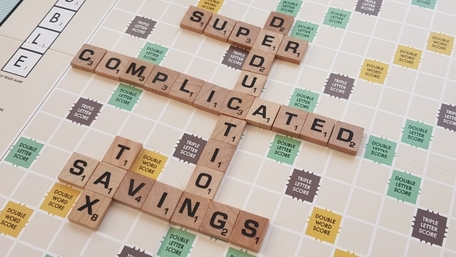

- Webinar: Super-deduction…130% Tax relief, but Super Complicated!

- CIL Property Tax Webinar

- CA Property Tax Webinar

- RICS Community Infrastructure Levy Talk - Stratford Upon Avon

- Portsmouth University CPD - Construction and Property Taxation

- RICS Community Infrastructure Levy Talk - Manchester

- RICS Community Infrastructure Levy Talk - London

- RICS Community Infrastructure Levy Talk - Ipswich

- Portsmouth University CPD - Construction and Property Taxation

- Property Taxation Breakfast Update

- RICS CPD Day, Cardiff

- RICS CPD Day, London

- RICS CPD Day, Exeter

- CIOT/ATT - Reading – Property Tax Seminar

- RICS CPD Day, Southampton

- CIOT/ATT - Leeds – Property Tax Seminar

- CIOT/ATT – Sheffield – Property Tax Seminar

- Property Taxation Lunch Update

- CIOT - Scottish Borders - Rural Day Conference

- Capital Allowances & CIL, Land Remediation Update - Wimborne

- CIOT - Thames Valley: Optimising Tax Savings

- Capital Allowances & CIL, Land Remediation Update - Dorchester

- Summer Breakfast Seminar

- VAT & Capital Allowances Lunch Seminar

- Business Networking Lunch

- London Property Tax and Tax Policy Update - 11th June 2014

- E3 Property Tax Update Series - Southampton

- MIPIM in Cannes - March 2010

- Rose Bowl Property Tax Seminar - 22nd June 2009

- E3 Consulting Sponsor Hampshire Golf Day - 7th May 2010

- Bournemouth Hotel and Catering Show - 10th March 2009

- Bournemouth Care Show Seminar - April 2008

- Property Taxation Breakfast Seminars - 2006

- E3 Consulting Sponsor Purbeck Film Festival - October 2007

- CIOT - East Midlands: Property - Capital Allowances and SDLT

- CIOT/ATT - Newcastle - Property Tax Seminar

- Property Taxation Update - Dorchester

- RICS CPD Day, Bristol

- VAT & Capital Allowances Update: The Reality

- What's Changed in the World of Property Tax?

- Risk Management & Property Tax

- Portsmouth University CPD - Commercial Property Taxation

- RICS CPD Day, Leeds

- Capital Allowances Seminar – The New Fixtures Rules - 22 March 2013

- CIOT/ATT - Oxford – Property Tax Seminar

- CPD Essentials: Quantity Surveyors Training Day - 14th November 2012

- LexisNexis webinar - 'Making the most of Capital Allowances' - 29th November 2011

- RICS Property Seminar - 15th March 2011

- Salisbury Property Taxation Seminar - 4th November 2010

- RICS Seminar - VAT on Listed Buildings - November 2010

- SPA Seminar - 30th September 2010

- E3 Charity Quiz Night and Curry - 16th April 2010

- Dorchester Property Tax Seminar - 24th November 2009

Webinar: Super-deduction…130% Tax relief, but Super Complicated!

Thursday 25th March 2021, 11:00am.

E³ Consulting held a property tax webinar reviewing the recent Budget Statement changes/proposal impacting UK tax payers. Our specialists provided insights into the significant changes to the capital allowances regime.

Whilst Rishi Sunak’s Budget Day announcement garnered lots of positive headlines – but as ever the ‘devil is in the detail’. The Capital Allowances Act 2001 was the first of the ‘new’ simplified tax legislation under the Tax Law Re-write and Government constantly talks about simplifying UK tax legislation – yet at almost every turn the rules seem to get more and more complex with different impacts for different sectors and business.

We explained the draft legislation and how you can optimise your potential tax savings from your property expenditures. We also shared top tips and real-life case studies to illustrate how our property taxation expertise has saved our clients’ money, time and delivered reduced risks and anxiety too!

E³ Consulting's Alun Oliver, Managing Director, and Todd Arnison, Property Tax Surveyor, discussed How to Manage Property Tax Risks and optimise tax savings for you and/or your clients.

Event Details

Thursday 25 March 2021

Registration/technology connection was from 1045 with Presentation from 1100 through to 1200 (noon) including time for Questions & Answers.

Who benefitted from attending?

High net worth individuals, Family/Owner managed businesses, Real Estate investors, owners/occupiers and those professionals advising, such as solicitors, surveyors, architects or planning consultants; working alongside their clients.

Why did attendees join?

To gain a better understanding of property taxation and how much money you and/or your clients could save. Gain current insights to appreciate the complexities surrounding the new Super-deduction and boosted First Year Allowances as well as the proposals for Freeports across the UK. Understand the potential benefits of engaging a property tax specialist and taking timely, expert advice. Hear practical project case studies to illustrate good practice, compliant procedures and how to mitigate risk and optimise savings or cash flow as may be possible.

Share this page

RSS

- This page can be found in the following news feeds:

- E3 Consulting News