- RICS CIL Index 2026 Announcement

- September 2025 Roundup

- 'Gunfleet Sands' case to be heard at Supreme Court

- HMRC launches consultation on Land Remediation Tax Relief

- VOA moving on … to become integral part of HMRC

- Consultation postponed on the tax treatment of predevelopment costs

- Todd joins RICS as Chartered Surveyor

- VAT – First Tier Tax Tribunal - Decision Update

- Mersey Docks and Harbour Company Wins Capital Allowances Case

- VAT Changes to Private Schools

- Spring Forecast scheduled for 26 March 2025

- E³ Consulting wishes you a Merry Christmas

- Property professionals unpick the Budget

- RICS CIL Index 2025 Announcement

- Elliott makes a difference

- E3 Consulting wins 'Best Independent Tax Consultancy Firm'

- SPA Annual Golf Day 2024

- We will be at the South East Construction Expo

- Finalist in 2024 Taxation Awards

- Planning Enforcement Changes to take effect from 25 April 2024 - LURA2023

- Spring Budget 2024

- Pilgrim's Progress: VOA Appeal Decision

- Deadline looming for registration of Scottish property owners

- Nowhere to hide for Furnished Holiday Let owners

- 100% Full Expensing made permanent

- SPA Clay Shoot 2023

- We are exhibiting at UKREiiF 2023

- Welsh Freeports - The two winning bids are...

- Chancellor announces Full Expensing

- 100% Tax relief confirmed for two Scottish Green Freeports

- Making Your Furnished Holiday Lettings More Profitable

- Happy New Year 2023

- Second U-Turn in Urenco Chemplants Case – Court of Appeal Decision

- How Specialists help to Save through Property Tax

- E3 Consulting on the move in London

- Autumn Statement (November): impact on capital allowances

- December Roundtable - Community Infrastructure Levy & Land Remediation Tax Relief

- E3 goes to top with calls for planning re-think

- The Chancellor’s ‘Mini Budget’ – A Tax Bonfire!

- HM Queen Elizabeth II

- Gardiner v Hertsmere - Court of Appeal Judgment

- E3 Consulting's new main office in Wimborne

- Green light for Freeports

- Buried treasure?

- And the winner is...

- Cavernous divide in ‘plant’ arguments

- And the finalists are…

- E3 Consulting puts property tax on the radar

- Help E3 Consulting grow in a nurturing environment

- Spring Statement 2022 – Real Estate & Construction Update

- E3 joins the dots with Building People

- Property Marketing Awards 2022 – Celebrating 30 years of PMA

- Navigating choppy waters

- E3 helps GPs go green with trailblazing surgery

- CIL – New Research Lays Bare Planning Cost

- Webinar success as spotlight shines on Super-deduction

- CIL appeal win saves householder £22,000

- Business Analyst Flo joins E³

- Budget Day Autumn 2021

- Firing on all cylinders

- LRTR Boost your Tax Savings & Unlocking Toxic Land

- CIL by Numbers!

- Shining the legal spotlight on capital allowances

- UPDATE: 130% Super-deduction to be available for landlords

- Specialist speakers announced for CIL webinar panel discussion

- Happy 18th birthday…to us!

- Land remediation myths cleared up at conference

- E³ Consulting – 18th anniversary

- Tax Day 23 March 2021 … over hyped & under whelming!

- Super-deduction…super insight from E³ Consulting’s webinar

- Budget 2021 – Update – Super Deduction

- Budget 2021 Update – Significant tax breaks for freeports announced

- Budget – 2021 – Small Profit Corporation Tax Rate

- UK FREEPORTS - Will Tax Incentives Fulfil Their Purpose?

- E³ Consulting Support Minstead Trust’s Online Christmas Raffle

- E³ Consulting’s Autumn Property Tax Webinars

- £1m AIA Extension

- Alun Oliver becomes CEDR Accredited Mediator

- Property & Construction Update

- Community Infrastructure Levy (CIL) - New Year, new rules!

- Budget 2020 - Wish list for Eco friendly Buildings

- Todd Arnison joins YEP Southampton committee

- Welcome to our Winter update!

- RICS Community Infrastructure Levy Talks

- University Award for Apprentice Todd

- Toasting a Record Year for E3 Consulting

- It was 'Not Too Taxing' for the E3 Team at the SPA Clay Shoot

- Finalist in 2019 Accounting Excellence Awards - Specialist Team of the Year

- Finalist in 2019 Taxation Awards - Best Independent Tax Consultancy Firm

- Celebrating 15 Years in Style

- Consulting Boutiques: A Different Perspective on Consulting

- Studying Modern Languages: what skills do you gain and how are these relevant in work?

- It's all in the Mind

- Capital allowance changes consultation

- International Invasive Weed Conference

- Significant tax savings illuminated at London landmark

- So close for Todd in national award

- Taxing matters for property sector - Seminar 17 October 2018

- National award shortlist for apprentice Todd

- Three top tips for organising a fundraising event - and how these are relevant in business

- Alun takes seat on CLA regional board

- E3's Tax Trappers at it again at the SPA Clay Shoot

- Property Tax Update at Athelhampton House

- Welcome to our New Property Tax Surveyor

- Success at the JCI UK National Convention 2017

- Defeat for Taylor Wimpey on Builder's Block VAT Claim

- Non-Resident Landlords (NRL) to move into Corporation Tax Regime

- Joining JCI Southampton as a Corporate Partner

- Signatory to the RICS Inclusive Employer Quality Mark

- E3 Consulting Sponsors Hampshire Hot Shots!

- S.O.S.! Tackling the Housing Crisis, CIL and Build to Rent

- International Women's Day: Making a Commitment to Diversity and Equal Opportunities

- CPD Property Tax Talks

- Why E3 Consulting Employs Interns

- Re-joining the Dorset Chamber of Commerce & Industry

- Welcoming New Interns to E3's Team

- Sponsorship of Alresford Town Football Club

- Finalist in 2015 Taxation Awards - Tax Consultancy Firm

- University of Warwick's Proactive Support of SME Businesses

- Property Taxation Specialist - Finalist in 2014 Taxation Awards

- VAT Specialist, Martin Scammell, Wins Indirect Tax Award

- Capital allowances claims using sampling for fixtures: HMRC Brief

- Business Property Relief on FHLs

- Victory in the 9th annual Solent Property Tennis Tournament

- Industry Response to HMRC's Capital Allowances proposals

- Winning Partnership with Rose Bowl Plc

- E3 Consulting Wins at Taxation Awards 2011

- E3 Consulting Shortlisted for Lexis Nexis Taxation Awards 2011

- Property Taxation Planning Opportunities - November 2010

- E3 Consulting Crowned Mixed Doubles Tennis Champions!

Budget 2021 – Update – Super Deduction Announced for 130% Capital Allowances

Update from Budget 2021 announcement on 03 March 2021.

.jpg)

Budget Announcement

Chancellor of the Exchequer, Rishi Sunak MP, announced in his Budget Statement earlier today (03/03/2021) that from 1 April 2021 until 31 March 2023, companies investing in qualifying new plant and machinery assets will be able to claim:

- a 130% super-deduction capital allowance on qualifying plant and machinery investments; and

- a 50% first-year allowance for qualifying special rate assets.

According to HM Revenue & Customs, this ‘super-deduction’ will allow companies to cut their tax bill by approximately 25p for every £1 they invest, ensuring the UK capital allowances regime is amongst the world’s most competitive.

The government has offered unprecedented support for businesses during Covid. Even so, pandemic-related economic shocks and the accompanying uncertainty have chilled business investment. This super-deduction will encourage firms to invest in productivity-enhancing plant and machinery assets that will help them grow, and to make those investments now.

Draft Legislation

The proposed draft Finance Bill 2021 seeks to makes legislative changes to Part 2 of the Capital Allowances Act 2001 (CAA2001). The key changes for the ‘Super-deduction’ and ‘SR Allowance’ are set out below:

- expenditure must be incurred on or after 01 April 2021 up to and including 31 March 2023;

- only for companies within the charge to UK Corporation Tax;

- a ‘Super-deduction’ providing allowances of 130% on most Main Pool expenditure - that would ordinarily qualify for 18% main rate writing down allowances (Plant & Machinery);

- a first year allowance of 50% (‘SR Allowance’) on most Special Rate Pool expenditure - that would ordinarily qualify for 6% special rate writing down allowances (Integral Features, Long Life Assets & Thermal Insulation);

- must not be within any of the general exclusions under s.46(2) CAA2001;

- amended rules covering expenditure used partly in a ring fence trade in the oil and gas sector;

- excludes expenditure from any contacts executed prior to Budget day (03 March 2021); and

- apportionment will be required for accounting periods that straddle 01 April 2023 - the rate should be apportioned based on days falling prior to 01 April 2023 over the total days in the accounting period.

There are further factors, in addition to the key points above, which taxpayers may need to consider in order to benefit from these new enhanced rates of relief. Please contact us to clarify any specific queries or project requirements.

*Source: HM Treasury

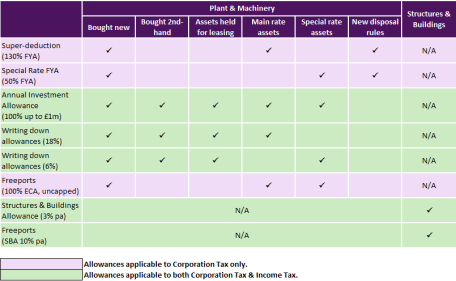

*Download pdf of table on right of page for better image quality.

Our View

Alun Oliver, Managing Director of Property Taxation Specialists E3 Consulting, commented “this is a new and untested enhancement to the UK capital allowances regime and clearly intended to encourage UK Companies to expedite any investment – which the Government no doubt wants to see as a catalyst to wider economic activity. Whilst any boost to capital allowances is always welcome it is disappointing to see the measure only applies to companies (– subject to Corporation Tax) given that much economic activity is through other entities such as LLPs, individuals or ‘old style’ partnerships. Additionally, the timings will further complicate the interaction with Integral Feature Allowances (IFAs) subject to the 50% First Year Allowances and the existing 100% relief through Annual Investment Allowances (AIAs) on the first £1m – until 31/12/21”.

Share this page

Document downloads

-

- Different allowances table

- Eligibility of different types of investments for different types of capital allowances.

- pdf (306.24kb)

RSS

- This page can be found in the following news feeds:

- E3 Consulting News