- Court of Appeal decision in Orsted West of Duddon Sands (UK) Ltd and others v CRC

- Food for thought?

- Comment on Autumn Budget 2024

- An interview with…Alun Oliver FRICS

- FHLs – Abolition of Tax Breaks

- Autumn Statement 2023 - Property Tax Update

- Elective surgery

- Building a new world

- Budget 2023 - Initial Reaction

- Register of Overseas Entities - Anti-Money Laundering Update

- Autumn Statement – Tax Bonfire! Real Estate & Construction Update

- Is anybody listening?

- Infrastructure Levy (IL)

- Land of confusion? Making sense of the Community Infrastructure Levy

- Who will guard the guards themselves

- LRTR Boost your Tax Savings & Unlocking Toxic Land

- Comedy of errors goes to High Court

- Budget 2021 - Property & Construction Initial Reaction

- Ignorance is No Defence!

- Steadfast Manufacturing & Storage Limited v HMRC – Case Law Update

- "Cash is King" ... Boost Post Coronavirus Cash Flows by Revisiting Historic Property Expenditure

- Jumping the Gun - E³ Consulting comment on Oval Estates Decision [2020] EWHC 457 (Admin)

- When the Levy Breaks… Coronavirus impact on CIL

- 100% ECAs Withdrawn, but Tax Savings Still Available

- Budget 2020 - Reaction

- Postponement of the UK VAT domestic reverse charge

- Edge of Tomorrow - Land remediation tax relief: ten years on

- Sudden Impact!

- Budget 2018 - Reaction

- Tax breaks lessen MEES impact on commercial property landlords

- #AS2016 – Real Estate & Construction Update

- An Inspector Calls - Planning Appeal decision

- First Tier Tribunal decision in Susanna Posnett v HMRC

- A Sledge Hammer Approach

- Dodging a Bullet

- Purpose Built Student Accommodation (PBSA)

- Budget 2016 - Reaction

- Reaction to Spending Review & Autumn Statement 2015

- Fistful of Dollars

- Caring for Your Cash Flow – Property Tax

- Shut the Barn Door

- Pub Conversion Projects – Should I Be Paying Value Added Tax (VAT)?

- The Long & Winding Road: Tax Landscape Evolving

- The Good, the Bad and the Ugly

- Budget 2014 - Reaction

- Adapting to Change - Capital Allowances April 2014

- Autumn Statement 2013

- Are you squeezing all the available tax relief out of your property?

- Investment Property Forum Focus: Spotlight on Tax Planning

- Mist Clears - Autumn Statement

- Fool's Gold

- Real Estate Tax Update

- J D Wetherspoon's Expected Outcome - 'Just & Reasonable'

- Capital Allowances Tax Relief on Restaurants, Bars & Hotels

- E3 Consulting Advises Rose Bowl on Cricket Stadium Development

- Energy Efficiency and Property Tax Savings

Budget 2021 - Property & Construction Initial Reaction

Has the Chancellor, Rishi Sunak MP, achieved the right balance between continued C-19 economic support and beginning to replenish Government coffers?

Today, (Wednesday 03 March 2021) the Chancellor, Rishi Sunak MP, made his second Budget Statement. Announcing various fiscal incentives to help re-energise the UK economy and particularly extended measures to support the delicate recovery of our leisure, hospitality and tourism businesses.

This Property & Construction update focusses on sector specific measures.

“A surprising level of continued support together with a varied array of measures to help encourage spending in key sectors, protect jobs and stimulate further employment and economic growth and investment across a range of business sectors. With some ‘telegraphing’ of future tax rises but targeted at larger businesses – better able to afford them” - Alun Oliver, E³ Consulting Managing Director.

Further details are expected over the next few days. Herewith we draw upon the ‘Red Book’ details summarised below. This summary focuses on the key tax, property and construction changes and does not cover all aspects:

2.68 An increase in the rate of corporation tax

From April 2023 will help repair the public finances. This will come into effect well after the point when the OBR expects the economy to return to pre-pandemic levels and on the back of an unprecedented period of support for business investment through a 130% upfront capital allowances super-deduction for investment in plant and machinery. Furthermore, the UK’s corporation tax rate will, at 25%, remain the lowest in the G7, with a small profits rate of 19% being introduced to provide protection to the smallest businesses.

2.111 Super-deduction

From 1 April 2021 until 31 March 2023, companies investing in qualifying new plant and machinery assets will benefit from a 130% first-year capital allowance. This upfront super-deduction will allow companies to cut their tax bill by up to 25p for every £1 they invest, ensuring the UK capital allowances regime is amongst the world’s most competitive. Investing companies will also benefit from a 50% first-year allowance for qualifying special rate (including long life) assets.

2.112 UK Infrastructure Bank

The new UK Infrastructure Bank will provide financing support to private sector and local authority infrastructure projects across the UK, to help meet government objectives on climate change and regional economic growth. The Bank will:

- be able to deploy £12 billion of equity and debt capital and be able to issue up to £10 billion of guarantees

- offer a range of financing tools including debt, hybrid products, equity and guarantees to support private infrastructure projects

- from the summer, offer loans to local authorities at a rate of gilts + 60 basis points for strategic infrastructure projects

- establish an advisory function to help with the development and delivery of projects

The institution will begin operating in an interim form later in spring 2021. The Bank will be headquartered in Leeds. Further details on the mandate and scope for the Bank are set out in the ‘UK Infrastructure Bank Policy Design’ document, published alongside the Budget.

2.113 Freeports in England

East Midlands Airport, Felixstowe & Harwich, Humber, Liverpool City Region, Plymouth and South Devon, Solent, Teesside and Thames have been successful in the Freeports bidding process for England. Subject to agreeing their governance arrangements and successfully completing their business cases, these Freeports will begin operations from late 2021. The Freeports will contain areas where businesses will benefit from more generous tax reliefs, customs benefits and wider government support, bringing investment, trade and jobs to regenerate regions across the country that need it most.

2.114 Freeports in Scotland, Wales and Northern Ireland

Freeports will benefit the whole of the UK. Discussions continue between the UK Government and the devolved administrations to ensure the delivery of Freeports in Scotland, Wales and Northern Ireland as soon as possible.

2.115 Tax sites in Freeports

The government will legislate for powers to create ‘tax sites’ in Freeports in Great Britain; it will bring forward legislation to apply in Northern Ireland at a later date. Tax sites within Freeports will need to be approved and confirmed by the government. Businesses in these tax sites will be able to benefit from a number of tax reliefs.

- An enhanced 10% rate of Structures and Buildings Allowance for constructing or renovating non-residential structures and buildings within Freeport tax sites in Great Britain, once designated. This means firms’ investments will be fully relieved after 10 years compared with the standard 33 ¹/³ years at the 3% rate available nationwide. This will be made available for corporation tax and income tax purposes. To qualify, the structure or building must be brought into use on or before 30 September 2026.

- An enhanced capital allowance of 100% for companies investing in plant and machinery for use in Freeport tax sites in Great Britain, once designated. This will apply to both main and special rate assets, allowing firms to reduce their taxable profits by the full cost of the qualifying investment in the year it is made, and will remain available until 30 September 2026.

- Full relief from Stamp Duty Land Tax on the purchase of land or property within Freeport tax sites in England, once designated. Land or property must be purchased and used for a qualifying commercial purpose. The relief will be available until 30 September 2026.

- Full Business Rates relief in Freeport tax sites in England, once designated. Relief will be available to all new businesses, and certain existing businesses where they expand, until 30 September 2026. Relief will apply for five years from the point at which each beneficiary first receives relief.

- Subject to Parliamentary process and approval, the government also intends to make an employer National Insurance contributions relief available for eligible employees in all Freeport tax sites from April 2022 or when a tax site is designated if after this date. This would be available until at least April 2026 with the intention to extend for up to a further five years to April 2031, subject to a review of the relief.

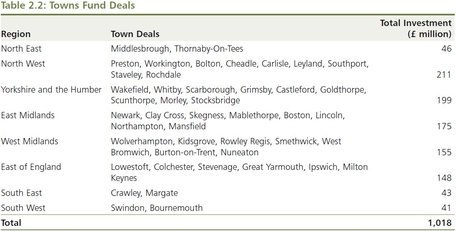

2.121 Towns Fund

The government is confirming over £1 billion from the Towns Fund for a further 45 Town Deals across England. This will help to level up regional towns, giving them the tools to design and implement a growth strategy for their area and aiding local recovery from the impacts of COVID-19.

2.122 New Deal for Northern Ireland

The government will allocate almost half of the £400 million New Deal for Northern Ireland funding package to four areas, subject to business cases: new systems for supermarkets and small traders to manage new trading arrangements; building greater resilience in medicine supply chains; promoting Northern Ireland’s goods and services overseas; and supporting skills development.

2.123 UK Community Renewal Fund prospectus launch

The government is launching the prospectus for the £220 million UK Community Renewal Fund alongside Budget.23 23 ‘UK Community Renewal Fund prospectus’, HM Treasury & Ministry of Housing, Communities and Local Government, March 2021. This will support communities across the UK in 2021-22 to pilot programmes and new approaches as the government moves away from the EU Structural Funds model and towards the UK Shared Prosperity Fund.

2.124 Community Ownership Fund

The government will create a new £150 million Community Ownership Fund to help ensure that communities across the UK can continue to benefit from the local facilities and amenities that are most important to them. From the summer, community groups will be able to bid for up to £250,000 matched funding to help them to buy local assets to run as community-owned businesses. In exceptional cases up to £1 million of matched funding will be available to help establish a community-owned sports club or buy a sports ground at risk of loss from the community. This will help ensure that important parts of the social fabric – like pubs, sports clubs, theatres and post office buildings – can continue to play a central role in towns and villages across the UK.

2.125 Modern Methods of Construction (MMC) Taskforce

The Ministry of Housing, Communities and Local Government (MHCLG) will establish an MMC Taskforce, backed by £10 million of seed funding, to accelerate the delivery of MMC homes in the UK. The Taskforce will consist of world-leading experts from across government and industry to fast-track the adoption of modern methods of construction. It will be headquartered in MHCLG’s new office in Wolverhampton. The Taskforce will work closely with local authorities and Mayoral Combined Authorities, including the West Midlands Combined Authority and the Liverpool City Region who have already brought forwards ambitious proposals.

2.126 National Infrastructure Commission (NIC) Towns and Regeneration study

The government will commission a new NIC study on towns and regeneration, which will consider how to maximise the benefits of infrastructure policy and investment for towns in England.25 Any recommendations in reserved areas will be relevant to the whole of the UK.

2.127 Regional cultural infrastructure

The government will invest £18.8 million in local cultural infrastructure projects in Carlisle, Hartlepool, Wakefield and Yeovil to boost the vibrant cultural life of these towns and cities.

2.134 Flood schemes

The £5.2 billion flood and coastal defence programme for England announced at Budget 2020 will start in April this year, with schemes in Waltham Abbey, Sunderland, Preston, Warrington, Salisbury, Rotherham and Doncaster expected to start construction in 2021-22. These schemes will better protect over 3,700 homes from flooding.

2.135 Offshore wind ports infrastructure

The government will make an offer of support, in principle, to the Able Marine Energy Park on Humberside following the conclusion of the competition to upgrade ports infrastructure for the next generation of offshore wind. The government will also sign a memorandum of understanding with Teesworks Offshore Manufacturing Centre on Teesside to support the development of another offshore wind port hub.26

3.20 Driving UK-wide investment and innovation

The government is committed to stimulating private sector investment to create jobs, develop hubs of innovation, and revitalise local areas and regions across every part of the UK. Businesses in Scotland, Wales and Northern Ireland will directly benefit from Budget measures such as:

- a new super-deduction, allowing companies to cut their tax bill by up to 25p for every £1 they invest in qualifying new plant and machinery assets, ensuring the UK capital allowances regime is amongst the world’s most competitive

- the UK Infrastructure Bank, which will partner with the private sector and local government to increase infrastructure investment to help tackle climate change and promote economic growth across the UK

- Help to Grow: Management, the government’s new management programme to upskill up to 30,000 SMEs across the UK over three years

- Help to Grow: Digital, the government’s new scheme to provide free online advice and a discount to adopt productivity-enhancing software that will help up to 100,000 SMEs across the UK save time and money

- the £375 million Future Fund: Breakthrough, a new direct co-investment product to support the scale-up of the most innovative, R&D-intensive businesses

- green energy innovation schemes from the government’s £1 billion Net Zero Innovation Portfolio to support the development of new solutions to cut carbon emissions and accelerate near-to-market low-carbon energy innovation

3.21 Levelling up and empowering all UK communities

Communities in Scotland, Wales and Northern Ireland will benefit from policies aimed at supporting people and places directly, in all parts of the UK. Examples of these policies include:

- the £4.8 billion Levelling Up Fund, which will support local areas across the UK to invest in infrastructure that improves everyday life. This will include regenerating town centres and high streets, upgrading local transport and investing in culture and heritage, ensuring that community assets continue to serve local people across the whole UK

- the £220 million UK Community Renewal Fund prospectus launch, providing funding for local areas across the UK in 2021-22 for projects investing in people, communities and businesses

- the £150 million Community Ownership Fund, helping to ensure that communities across the UK can continue to benefit from the local facilities and amenities that are most important to them

- £27 million, subject to business case, for the Aberdeen Energy Transition Zone, £5 million, subject to business case, in additional support for the Global Underwater Hub and up to £2 million to further develop industry proposals as part of the government’s support for the North Sea Transition Deal

- £4.8 million, subject to business case, for a Holyhead hydrogen hub, which will create high skilled green jobs in Anglesey, Wales

- up to £30 million, subject to business case, that the government will match fund for the Global Centre for Rail Excellence in South Wales, which would support innovation in the UK’s rail industry, including the testing of cutting-edge, green technology

- the £400 million New Deal for Northern Ireland (NDNI) package, almost half of which has been allocated across four areas, subject to business cases: new systems for supermarkets and small traders to manage new trading arrangements; building greater resilience in medicine supply chains; promoting Northern Ireland’s goods and services overseas; and supporting skills development

Our View

Alun Oliver said “We believe this Budget announces a very comprehensive range of measures that are clearly intended to boost investment into the UK economy, whilst attempting to re-build public finances on the back of the unprecedented Government support over the Coronavirus pandemic. There are many aspects that will impact and support the construction, property & infrastructure sectors helping to provide valuable post covid-19 economic activity as well as wider Leisure & Hospitality sector support helping protect jobs at local, regional and nation levels. We now turn our attention to the draft tax legislation to ensure the delivery matches the Headlines!”.

Share this page

Related News

Document downloads

-

- BudgetStatement-03-03-2021

- Budget 2021 - Property & Construction Initial Reaction

- pdf (387.52kb)

RSS

- This page can be found in the following news feeds:

- E3 Consulting News