- Court of Appeal decision in Orsted West of Duddon Sands (UK) Ltd and others v CRC

- Food for thought?

- Comment on Autumn Budget 2024

- An interview with…Alun Oliver FRICS

- FHLs – Abolition of Tax Breaks

- Autumn Statement 2023 - Property Tax Update

- Elective surgery

- Building a new world

- Budget 2023 - Initial Reaction

- Register of Overseas Entities - Anti-Money Laundering Update

- Autumn Statement – Tax Bonfire! Real Estate & Construction Update

- Is anybody listening?

- Infrastructure Levy (IL)

- Land of confusion? Making sense of the Community Infrastructure Levy

- Who will guard the guards themselves

- LRTR Boost your Tax Savings & Unlocking Toxic Land

- Comedy of errors goes to High Court

- Budget 2021 - Property & Construction Initial Reaction

- Ignorance is No Defence!

- Steadfast Manufacturing & Storage Limited v HMRC – Case Law Update

- "Cash is King" ... Boost Post Coronavirus Cash Flows by Revisiting Historic Property Expenditure

- Jumping the Gun - E³ Consulting comment on Oval Estates Decision [2020] EWHC 457 (Admin)

- When the Levy Breaks… Coronavirus impact on CIL

- 100% ECAs Withdrawn, but Tax Savings Still Available

- Budget 2020 - Reaction

- Postponement of the UK VAT domestic reverse charge

- Edge of Tomorrow - Land remediation tax relief: ten years on

- Sudden Impact!

- Budget 2018 - Reaction

- Tax breaks lessen MEES impact on commercial property landlords

- #AS2016 – Real Estate & Construction Update

- An Inspector Calls - Planning Appeal decision

- First Tier Tribunal decision in Susanna Posnett v HMRC

- A Sledge Hammer Approach

- Dodging a Bullet

- Purpose Built Student Accommodation (PBSA)

- Budget 2016 - Reaction

- Reaction to Spending Review & Autumn Statement 2015

- Fistful of Dollars

- Caring for Your Cash Flow – Property Tax

- Shut the Barn Door

- Pub Conversion Projects – Should I Be Paying Value Added Tax (VAT)?

- The Long & Winding Road: Tax Landscape Evolving

- The Good, the Bad and the Ugly

- Budget 2014 - Reaction

- Adapting to Change - Capital Allowances April 2014

- Autumn Statement 2013

- Are you squeezing all the available tax relief out of your property?

- Investment Property Forum Focus: Spotlight on Tax Planning

- Mist Clears - Autumn Statement

- Fool's Gold

- Real Estate Tax Update

- J D Wetherspoon's Expected Outcome - 'Just & Reasonable'

- Capital Allowances Tax Relief on Restaurants, Bars & Hotels

- E3 Consulting Advises Rose Bowl on Cricket Stadium Development

- Energy Efficiency and Property Tax Savings

All That Glitters is Not Gold!

Award winning firm E3 Consulting highlights the dangers of using "new entrant" capital allowances advisers - offering poor value for money

Snake Oil

In the old 'Wild West' Snake oil salesmen offered a Universal Elixir to solve all ailments - they seldom did as hyped! Using similar tactics to those 'pushing' Business ratings and SDLT solutions - these capital allowances new entrants - often claim 'special relationships with HMRC' or use of 'HMRC approved methodologies' or other plausible benefits. Too often the reality is that there is little or no substance behind the high profile websites and commission driven sales teams.

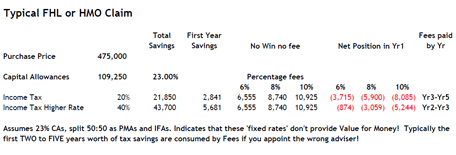

Over Egged Fees

Over the last six months E3 Consulting has had numerous new wins from clients initially approached by other firms - offering high levels of tax saving, with fixed fee options. To the unaware - particularly the irregular purchaser of tax services, on say FHLs or HMOs, these offers can seem good value. However what is seldom explained within the often pressurised sales process is that a VERY significant proportion of the tax savings available will be consumed by their fees! From our analyses of some of these "offers", between TWO and FOUR years worth of savings can be consumed by the fees. Not surprisingly those that take the time to do the maths or explore more established firms find better Value for Money.

* A combined article and table in pdf format can be downloaded on the right hand side of this page.

Professional Accreditation & Indemnity

Other areas to be wary of include firms that have no professional accreditations. E3 Consulting for example is regulated by Royal Institution of Chartered Surveyors (RICS) and also registered with HM Revenue & Customs for Money Laundering Regulations. Those advisers with professional bodies scrutinising their activities will also be required to have an appropriate level of Professional Indemnity Insurance (PII) cover - insurance in the event of errors or mistakes. Unfortunately there are some that operate without any PII or cap the levels of PII cover so low (often below the level of fees requested) - offering their clients no real protection in the event of there being some problem.

Forewarned is forearmed - If you have incurred capital expenditure on property and wish to explore the value of the potential tax savings available to you; or if you are a professional adviser - your clients - please contact us to see how we can help you save money and improve cashflow.

Share this page

Download a pdf version here

-

- E3 - Capital Allowances Fools Gold

- All That Glitters is Not Gold

- pdf (67.45kb)

RSS

- This page can be found in the following news feeds:

- E3 Consulting News