- Court of Appeal decision in Orsted West of Duddon Sands (UK) Ltd and others v CRC

- Food for thought?

- Comment on Autumn Budget 2024

- An interview with…Alun Oliver FRICS

- FHLs – Abolition of Tax Breaks

- Autumn Statement 2023 - Property Tax Update

- Elective surgery

- Building a new world

- Budget 2023 - Initial Reaction

- Register of Overseas Entities - Anti-Money Laundering Update

- Autumn Statement – Tax Bonfire! Real Estate & Construction Update

- Is anybody listening?

- Infrastructure Levy (IL)

- Land of confusion? Making sense of the Community Infrastructure Levy

- Who will guard the guards themselves

- LRTR Boost your Tax Savings & Unlocking Toxic Land

- Comedy of errors goes to High Court

- Budget 2021 - Property & Construction Initial Reaction

- Ignorance is No Defence!

- Steadfast Manufacturing & Storage Limited v HMRC – Case Law Update

- "Cash is King" ... Boost Post Coronavirus Cash Flows by Revisiting Historic Property Expenditure

- Jumping the Gun - E³ Consulting comment on Oval Estates Decision [2020] EWHC 457 (Admin)

- When the Levy Breaks… Coronavirus impact on CIL

- 100% ECAs Withdrawn, but Tax Savings Still Available

- Budget 2020 - Reaction

- Postponement of the UK VAT domestic reverse charge

- Edge of Tomorrow - Land remediation tax relief: ten years on

- Sudden Impact!

- Budget 2018 - Reaction

- Tax breaks lessen MEES impact on commercial property landlords

- #AS2016 – Real Estate & Construction Update

- An Inspector Calls - Planning Appeal decision

- First Tier Tribunal decision in Susanna Posnett v HMRC

- A Sledge Hammer Approach

- Dodging a Bullet

- Purpose Built Student Accommodation (PBSA)

- Budget 2016 - Reaction

- Reaction to Spending Review & Autumn Statement 2015

- Fistful of Dollars

- Caring for Your Cash Flow – Property Tax

- Shut the Barn Door

- Pub Conversion Projects – Should I Be Paying Value Added Tax (VAT)?

- The Long & Winding Road: Tax Landscape Evolving

- The Good, the Bad and the Ugly

- Budget 2014 - Reaction

- Adapting to Change - Capital Allowances April 2014

- Autumn Statement 2013

- Are you squeezing all the available tax relief out of your property?

- Investment Property Forum Focus: Spotlight on Tax Planning

- Mist Clears - Autumn Statement

- Fool's Gold

- Real Estate Tax Update

- J D Wetherspoon's Expected Outcome - 'Just & Reasonable'

- Capital Allowances Tax Relief on Restaurants, Bars & Hotels

- E3 Consulting Advises Rose Bowl on Cricket Stadium Development

- Energy Efficiency and Property Tax Savings

When the Levy Breaks… Coronavirus impact on CIL

In these extreme and unprecedented times, property developers and planning advisers are seeking urgent advice on measures to address issues caused by the Coronavirus pandemic on developments subject to imminent or scheduled payments of their CIL liabilities.

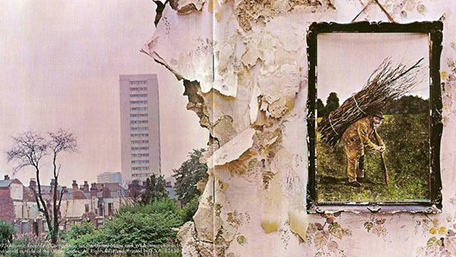

Image: Atlantic Records/Led Zeppelin

In these extreme and unprecedented times, property developers and planning advisers across England & Wales are seeking urgent advice from the Ministry of Housing, Communities & Local Government (MHCLG); on measures to address issues caused by the Coronavirus (Covid-19) pandemic on developments subject to imminent or scheduled payments of their Community Infrastructure Levy (CIL) liabilities.

The CIL Regulations are very rigid, inflexible and ill-prepared to meet the new and urgent challenges facing projects across the country. Many of which have strict payment terms set against fixed time spans from the date of commencement. Furthermore, the statutory challenges for a developer, or home owner, to challenge the CIL Liability calculated by their Local Planning Authority (LPA) must also be raised within strict timeframes – 28 days for a review under Reg.113 and within 60 days for an Appeal under Reg.114, both starting from the date of issue of the relevant Liability Notice.

Commencement

Submitting a Commencement Notice, (required by Reg.67) states when the development will commence on site and is an important part of the CIL procedures. Under s.208(3) Planning Act 2008 and CIL Reg.31, a previously assumed liability to pay CIL arises upon commencement of the chargeable development. This requires payment of CIL typically within 60 days of commencement date, albeit most Local Planning Authorities (LPAs) have some limited scope to extend payment terms over bespoke instalment intervals, depending upon the quantum and the respective LPA policy.

Commencement of the works generally leads to the CIL liability being fixed at the amount determined by the LPAs at that point. In other words, no further ‘Review’ or ‘Appeal’ can be made against the CIL liability determined, nor can any applications for exemptions or other reliefs applicable, be made after the commencement of works on site.

Contrary to the narrower contractual definition of ‘material works’, common in s.106 Agreements; for CIL purposes, development is treated under Reg.7(2) as beginning on the earliest date on which ‘material operation’ is carried out. ‘Material operation’ has the same (and stricter) statutory meaning as in s.56(4) of the Town and Country Planning Act 1990, and includes “any building works, demolition, digging of trenches for foundations or change in the use of land”.

Where a Commencement Notice is not submitted before work commences, the LPA may impose a surcharge of 20% of the total CIL value or £2,500, whichever is lower as well as demand immediate settlement of the CIL liability in full. Developers facing fiscal challenges from the Covid-19 lockdown and temporary hold on housing transactions, may struggle to maintain payments already committed too, before everything changed.

The most common CIL issue we see is commencement of works before all of the CIL matters are fully resolved; closely followed by the failure to submit and validate safe receipt by the LPA of their Commencement Notice (CIL Form 6).

Phased Planning

The CIL Regulations do permit developers to stagger their CIL payments but ONLY where they have explicitly sought a phased planning permission. Reg.9(4) allows each discrete phase of a project to be treated as a separate chargeable development and thus the CIL liability is calculated discretely for each respective phase, only becoming payable upon commencement of that specific phase. ‘Phased Planning Permission’ is covered under Reg.2(1) of the 2010 Regulations as “a planning permission which expressly provides for development to be carried out in phases”.

Whilst projects are delayed by site shut downs, or lack of necessary building materials, at least the next phase will be on hold too and CIL liabilities will not yet be activated by commencement.

Instalment Policy

The CIL Regulations permit LPAs to determine what, if any, instalment policy they operate to vary the default 60 day payment terms, whereby a policy under Reg.69B must state—

(a) the date on which it takes effect, which must be no earlier than the day after the instalment policy is published on the website;

(b) the number of instalment payments;

(c) the amount or proportion of CIL payable in any instalment;

(d) the time (to be calculated from the date the development is commenced) that the first instalment payment is due, and the time that any subsequent instalment payments are due; and

(e) any minimum amount of CIL below which CIL may not be paid by instalment.

By virtue of Reg.69B(4) a LPA can amend their instalment policy at any time, so long as they have not already changed it within the last 28 days - under Reg.69B(5).

Importantly, if there are any delays or non-payment of agreed instalments, this would lead to cancellation of any instalment plan. This would again trigger a demand for immediate full payment together with mandatory late payment interest, as applicable and possibly discretionary surcharges too, should the LPA determine these necessary!

The key to enabling cash-strapped developers with stalled or mothballed projects to avoid potentially catastrophic impact of Covid-19, is to ensure a good dialogue between the developer and LPA. This may allow the LPAs apply as much discretion as possible, to any of their myriad of enforcement powers, yet designed without global pandemics having been considered an essential part of drafting the legislation.

Legislative Change Needed

Whilst MHCLG, like all government departments have excelled at their speed of response to Covid-19 but are juggling a great many issues, many of which may arguably take higher priority in this National Emergency, they must also find time to consider solutions to these matters facing developers up and down the land. Failure to alleviate these real pinch points could undermine the developers, perhaps already embattling the economic conditions, and some sites – such that they may not see it through to a time when ‘normal business activity’ returns, on the other side of Coronavirus, which we all hope is soon!

The main ‘blocking point’ is Reg.70 that restricts the ability to amend the applicable instalment policy after commencement of works, or that imposes a mandatory full immediate payment due to Reg.70(8) after any breach.

Additionally, ‘exceptional circumstances relief’ under Reg.55 is only available if the relevant LPA has previously incorporated and published the basis of their relief in advance of the developer making a claim. Such relief only reduces the CIL liability and so would not address payment terms or timescales. Again the ‘perennial issue’ to CIL is that this relief can only be granted where the claim has been made in advance of commencement of the works. On top of these issues, the Greater London Authority does NOT permit any relief in exceptional circumstances from Mayoral CIL (MCIL), applicable across all the London Boroughs.

Conclusion

Immediate action is required by MHCLG and GLA to introduce temporary measures that would enable LPAs to effectively ‘press the pause button’ on a variety of CIL issues. Unusual times call for unusual solutions and thus emergency Covid-19 legislation should introduce new CIL Regulations - whether within Reg.69A -or elsewhere (perhaps a dedicated Covid-19 clause) - to facilitate an indeterminable deferral of CIL payments, timeframes and variation to existing instalment rules for the duration of the Coronavirus ‘lockdown’ – without undue delay.

In absence of specific emergency legislation, one expects that all LPAs would, in these troubled times, exercise all the available discretions in addressing any breach of instalment terms and look to find appropriate solutions to any developers facing severe financial, but temporary, challenges. The backdrop, however, is that LPAs generally apply the Regulations ‘to the letter’ and with limited scope for deviation from the procedural aspects. Now is the time for rare exceptions!

E³ Consulting’s team has advised upon a wide range of CIL projects across England & Wales. We are very familiar with the CIL Regulations and necessary processes to ensure clients comply with the legislative requirements, correctly assess their CIL Liabilities and take advantage of any reliefs or exemptions in mitigating their liabilities that may be available. We have successfully saved our clients millions of pounds from CIL, often where the client’s initial perception was that little or nothing could be done.

We work closely with developers and home owners as well as their respective architects, planners and project managers to ensure the correct CIL Liability is calculated and paid. We engage with the LPAs to ensure the liability is agreed at the correct amount (including any eligible exemptions or reliefs) and in a timely manner, so enabling site works to commence at the earliest opportunity, without triggering full CIL payment or unnecessary penalties.

E³ Consulting operate from offices in Southampton and London and work with clients that own, operate or invest in property across the UK and overseas. If you would like to discuss any aspects of this decision or its implications for you and/or your projects further, then please contact Alun Oliver for a no fee, no obligation initial discussion to see how we could help evaluate, evolve and enhance the available property tax savings from any property expenditure.

Share this page

RSS

- This page can be found in the following news feeds:

- E3 Consulting News

Document downloads

-

- Coronavirus impact on CIL

- Coronavirus impact on CIL

- pdf (323.10kb)