Dispute Resolution

Our team has a proven track record in dealing with HMRC enquiries, providing advisory services and acting as Technical Expert or Expert Witness in relation to property tax matters.

- Do you or your clients have an outstanding or ongoing enquiry with HMRC?

- Are you subject to professional negligence litigation or threat of litigation?

- Are you about to give up on a property tax relief claim and need a second opinion?

If any of these questions describe your current position then please get in touch as we have expertise in a wide range of dispute resolution matters affecting property expenditure and the tax savings available against this.

Dealing with HMRC

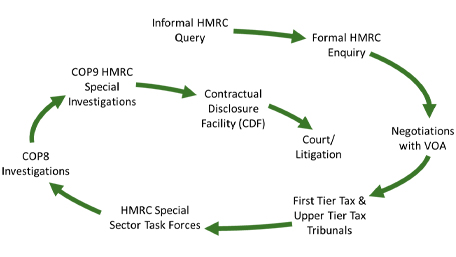

As property tax experts we regularly review, amend and advise upon existing Property Tax matters where HMRC may be disputing the tax position informally or via a formal tax investigation or enquiry or notice to provide information and produce documents relating to:

- Capital Allowances

- Repairs and Maintenance

- Land Remediation Tax Relief

- Value Added Tax (VAT)

We also negotiate with the Valuation Office Agency (VOA) and their National Asset Measurement Surveyors (NAMS) to establish the ‘correct’ apportionment of costs between building elements where this has been challenged, referred or disputed.

Litigation & Expert Witness

Professional negligence is a complex area but due to an increasing level of tax scrutiny by HMRC as well as complex and frequently changing tax law (including the new fixtures rules for capital allowances) we are seeing increasing levels of disputes – both with HMRC, but also between clients and their advisors.

We also provide expert witness and advisory services to investors or advisors subject to litigation or any parties involved in, contemplating or defending potential litigation issues; such as:

- Insurance companies underwriting professional indemnity insurance

- Solicitors

- Surveyors

- Accountants

To help understand what may have gone wrong on a project, the quantum of tax allowances/relief potentially available and the resulting tax savings or damages arising from potential negligent professional advice.

Our specialist Property Tax Surveyors have successfully advised both Claimants and Defendants and bring their extensive project experience to bear on any tax dispute. E3 Consulting has helped resolve complex tax claims including those by HMRC Special Investigations team under COP9.

Whatever the nature of your property tax dispute our team will help you understand they key facts and devise an effective strategy to resolve the matter quickly and cost effectively and without the need for expensive, time sapping litigation through the courts.

Getting a Second Opinion

If you are about to concede a claim for tax relief because HMRC has resisted your arguments or explanations to date – it may be useful to consider a fresh pair of eyes - our property tax specialists can help to resolve claims in a timely and satisfactory manner by reviewing prior claims project correspondence and legal precedents.

Bringing our team’s experience and expertise to bear on your particular situation can ensure you’re not unduly foregoing tax relief that is rightly available due to the intransigence of HMRC or possible lack of understanding of the correct tax position by your current advisors.

Pre-Emptive Strike

Disputes can arise from having poor data, erroneous or negligent submissions or advice. The best way to avoid the anxiety and expense of a dispute is to prevent them from occurring in the first place.

Managing your tax function and complying with all relevant requirements can mean you’re constantly evolving – ‘Forth Bridge Syndrome’. However our property tax surveyors can help to review your tax and ledger systems to audit and consider the quality of your data capture and resulting property tax submissions or claims. A tax audit or risk review can help improve your systems improving the quality and robustness of your claims for tax relief resulting from your property expenditures as well as demonstrate compliance with Senior Accounting Officer (SAO) requirements for larger businesses.

Mini Case Study

To illustrate E3 Consulting’s credentials in resolving HMRC disputes and enquires, we recently helped a client on a shopping centre refurbishment in Yorkshire where HMRC were challenging a Repairs and Maintenance deduction of £150,000 prepared by the project Quantity Surveyor; but with very little information being sent to HMRC to substantiate the claim. E3 were brought in to support the client by their tax advisors with whom we’d previously worked, and after carefully analysing the full project spend, the resulting Repairs and Maintenance deduction agreed with HMRC was over £890,000 with a further £1.95 million of Capital Allowances - saving the client £500,000.

Contact us

For more information call a member of our team on 0345 230 6450 or by completing the adjacent enquiry form for a no obligation, no fee initial discussion.

From our experience you’ll most likely be surprised at what we can achieve.