Repairs and Maintenance

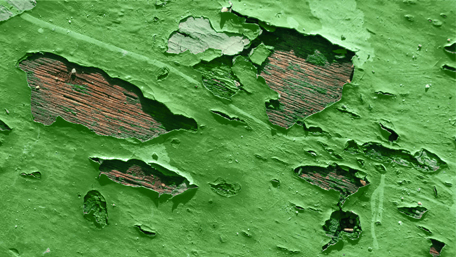

Straightforward repairs or 'like for like' replacements are an allowable revenue expense deduction at 100% from taxable profits in the same year.

Capital vs Revenue

Building refurbishment projects will typically incur a mixture of capital costs and revenue expenses. E3 Consulting can help clients by analysing their expenditure and segregating the costs into the appropriate constituent parts; identifying their eligibility to the 100% deductions arising from any appropriate revenue expenditure incorporated within their project(s).

To qualify for the deduction as a revenue expense, expenditure on an asset must not be, or deemed to be for the purposes of, a property improvement.

As the correct categorisation of allowable repairs and maintenance will provide significant tax savings, this aspect of property taxation should be given careful consideration by all property owners, investors, developers, occupiers, and their professional advisers.

Towards the end of a lease, occupiers start to think of their dilapidations, but often fail to consider the potential tax relief that sits alongside these costs.

Capital Allowances

Where the expenditure is not eligible for a 100% revenue deduction because it constitutes an alteration or improvement, the taxpayer should always consider the optimisation of all available capital allowances.

Capital allowances are an available relief for capital expenditure on commercial property, furnished holiday lets or common areas of large scale residential property.

When incurring expenditure on the repair or maintenance of integral features assets, a sub-category of capital allowances introduced in April 2008, distinctive rules regarding the classification as revenue or capital take effect. These assets include, but are not limited to, general electrical and lighting installations, hot and cold water installations and heating, ventilation & air conditioning (HVAC) installations; all of which are common plant and machinery in commercial properties. Therefore, it is important to seek specialist advice in allocating expenditure.

Structures and Buildings Allowances

The Structures and Buildings Allowance (SBA), introduced via the Autumn Budget 2018, does not include expenditure on the provision of repairs and maintenance relief. Therefore, for tax payers to benefit from all of the available property taxation relief and truly optimise their tax savings, they will need to undertake some form of detailed segregation analysis of the project expenditure into the various forms of allowances or revenue deductions applicable.

Specialist skills for specialist tasks

Our services in this area of property taxation frequently involve us being brought in to negotiate claims after HM Revenue & Customs (HMRC) has challenged those assessments made by other non-specialists.

Our detailed working knowledge of the precedent case law, and understanding the full extent of construction costs, enables us to successfully defend claims and regularly improve upon the original position; thus enhancing the available property tax savings for our clients.