- RICS CIL Index 2026 Announcement

- September 2025 Roundup

- 'Gunfleet Sands' case to be heard at Supreme Court

- HMRC launches consultation on Land Remediation Tax Relief

- VOA moving on … to become integral part of HMRC

- Consultation postponed on the tax treatment of predevelopment costs

- Todd joins RICS as Chartered Surveyor

- VAT – First Tier Tax Tribunal - Decision Update

- Mersey Docks and Harbour Company Wins Capital Allowances Case

- VAT Changes to Private Schools

- Spring Forecast scheduled for 26 March 2025

- E³ Consulting wishes you a Merry Christmas

- Property professionals unpick the Budget

- RICS CIL Index 2025 Announcement

- Elliott makes a difference

- E3 Consulting wins 'Best Independent Tax Consultancy Firm'

- SPA Annual Golf Day 2024

- We will be at the South East Construction Expo

- Finalist in 2024 Taxation Awards

- Planning Enforcement Changes to take effect from 25 April 2024 - LURA2023

- Spring Budget 2024

- Pilgrim's Progress: VOA Appeal Decision

- Deadline looming for registration of Scottish property owners

- Nowhere to hide for Furnished Holiday Let owners

- 100% Full Expensing made permanent

- SPA Clay Shoot 2023

- We are exhibiting at UKREiiF 2023

- Welsh Freeports - The two winning bids are...

- Chancellor announces Full Expensing

- 100% Tax relief confirmed for two Scottish Green Freeports

- Making Your Furnished Holiday Lettings More Profitable

- Happy New Year 2023

- Second U-Turn in Urenco Chemplants Case – Court of Appeal Decision

- How Specialists help to Save through Property Tax

- E3 Consulting on the move in London

- Autumn Statement (November): impact on capital allowances

- December Roundtable - Community Infrastructure Levy & Land Remediation Tax Relief

- E3 goes to top with calls for planning re-think

- The Chancellor’s ‘Mini Budget’ – A Tax Bonfire!

- HM Queen Elizabeth II

- Gardiner v Hertsmere - Court of Appeal Judgment

- E3 Consulting's new main office in Wimborne

- Green light for Freeports

- Buried treasure?

- And the winner is...

- Cavernous divide in ‘plant’ arguments

- And the finalists are…

- E3 Consulting puts property tax on the radar

- Help E3 Consulting grow in a nurturing environment

- Spring Statement 2022 – Real Estate & Construction Update

- E3 joins the dots with Building People

- Property Marketing Awards 2022 – Celebrating 30 years of PMA

- Navigating choppy waters

- E3 helps GPs go green with trailblazing surgery

- CIL – New Research Lays Bare Planning Cost

- Webinar success as spotlight shines on Super-deduction

- CIL appeal win saves householder £22,000

- Business Analyst Flo joins E³

- Budget Day Autumn 2021

- Firing on all cylinders

- LRTR Boost your Tax Savings & Unlocking Toxic Land

- CIL by Numbers!

- Shining the legal spotlight on capital allowances

- UPDATE: 130% Super-deduction to be available for landlords

- Specialist speakers announced for CIL webinar panel discussion

- Happy 18th birthday…to us!

- Land remediation myths cleared up at conference

- E³ Consulting – 18th anniversary

- Tax Day 23 March 2021 … over hyped & under whelming!

- Super-deduction…super insight from E³ Consulting’s webinar

- Budget 2021 – Update – Super Deduction

- Budget 2021 Update – Significant tax breaks for freeports announced

- Budget – 2021 – Small Profit Corporation Tax Rate

- UK FREEPORTS - Will Tax Incentives Fulfil Their Purpose?

- E³ Consulting Support Minstead Trust’s Online Christmas Raffle

- E³ Consulting’s Autumn Property Tax Webinars

- £1m AIA Extension

- Alun Oliver becomes CEDR Accredited Mediator

- Property & Construction Update

- Community Infrastructure Levy (CIL) - New Year, new rules!

- Budget 2020 - Wish list for Eco friendly Buildings

- Todd Arnison joins YEP Southampton committee

- Welcome to our Winter update!

- RICS Community Infrastructure Levy Talks

- University Award for Apprentice Todd

- Toasting a Record Year for E3 Consulting

- It was 'Not Too Taxing' for the E3 Team at the SPA Clay Shoot

- Finalist in 2019 Accounting Excellence Awards - Specialist Team of the Year

- Finalist in 2019 Taxation Awards - Best Independent Tax Consultancy Firm

- Celebrating 15 Years in Style

- Consulting Boutiques: A Different Perspective on Consulting

- Studying Modern Languages: what skills do you gain and how are these relevant in work?

- It's all in the Mind

- Capital allowance changes consultation

- International Invasive Weed Conference

- Significant tax savings illuminated at London landmark

- So close for Todd in national award

- Taxing matters for property sector - Seminar 17 October 2018

- National award shortlist for apprentice Todd

- Three top tips for organising a fundraising event - and how these are relevant in business

- Alun takes seat on CLA regional board

- E3's Tax Trappers at it again at the SPA Clay Shoot

- Property Tax Update at Athelhampton House

- Welcome to our New Property Tax Surveyor

- Success at the JCI UK National Convention 2017

- Defeat for Taylor Wimpey on Builder's Block VAT Claim

- Non-Resident Landlords (NRL) to move into Corporation Tax Regime

- Joining JCI Southampton as a Corporate Partner

- Signatory to the RICS Inclusive Employer Quality Mark

- E3 Consulting Sponsors Hampshire Hot Shots!

- S.O.S.! Tackling the Housing Crisis, CIL and Build to Rent

- International Women's Day: Making a Commitment to Diversity and Equal Opportunities

- CPD Property Tax Talks

- Why E3 Consulting Employs Interns

- Re-joining the Dorset Chamber of Commerce & Industry

- Welcoming New Interns to E3's Team

- Sponsorship of Alresford Town Football Club

- Finalist in 2015 Taxation Awards - Tax Consultancy Firm

- University of Warwick's Proactive Support of SME Businesses

- Property Taxation Specialist - Finalist in 2014 Taxation Awards

- VAT Specialist, Martin Scammell, Wins Indirect Tax Award

- Capital allowances claims using sampling for fixtures: HMRC Brief

- Business Property Relief on FHLs

- Victory in the 9th annual Solent Property Tennis Tournament

- Industry Response to HMRC's Capital Allowances proposals

- Winning Partnership with Rose Bowl Plc

- E3 Consulting Wins at Taxation Awards 2011

- E3 Consulting Shortlisted for Lexis Nexis Taxation Awards 2011

- Property Taxation Planning Opportunities - November 2010

- E3 Consulting Crowned Mixed Doubles Tennis Champions!

£1m Annual Investment Allowance Extension

HM Treasury announced on 12 November 2020 that the £1m cap on the Annual Investment Allowance (AIA) is to be extended until 31 December 2021.

The AIA – aptly named the ‘yo-yo allowance’ - initially increased from £200,000 to £1m on 01 January 2019 and was due to revert back to £200,000 from 01 January 2021. However, it has now been announced that this temporary increase to the £1m capped amount will remain in place for an additional year.

Background

AIAs give businesses tax relief on 100% (up to the annual cap for that period) of the majority of costs qualifying capital allowances expenditure in the year it is incurred.

Allowances are usually calculated annually as writing down allowances on a reducing balance basis, meaning that the relief is spread across a number of years. Currently at 18% p.a. for Plant and Machinery Allowances and 6% p.a. for Integral Features Allowances. Thus the opportunity to benefit from 100% relief in the year of expenditure can dramatically accelerate the immediate tax savings and boost cash flow.

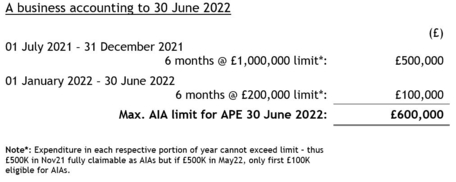

For those businesses where their accounting period ends on a date other than the date at which the limit changes (i.e. 31.12.YY), the AIA cap is adjusted pro rata to the different levels of cap for each part of the accounting period. For example:

AIAs are not available to Trusts or Partnerships where one or more of the constituent members are Limited companies – a measure introduced to combat wider tax abuse. Additionally, the relatively newly created Structures & Buildings Allowances (SBAs) are also excluded from being eligible for treatment as AIAs and thus can not be accelerated from their normal 3% per annum straight line relief over 33⅓ years.

Papering over the cracks?

The increased AIA extension is welcome news for businesses during a time when many are looking for ways to stabilise their bottom line and manage cash flows. A call that many advisers and professional bodies have been making in the industry for a number of months. However, it does pose the question of how much difference a single year’s extension can make? The Government’s original reason for increasing the AIA cap back in the Autumn 2018 Budget statement for 2019, along with other measures introduced, was to stimulate investment in the UK real estate sector, and make the UK a destination for investment over other top European countries – as a BREXIT measure. Though, with almost an entire year lost to the Covid-19 pandemic, investors need time to regroup, plan and then implement further investment changes.

The vast majority of projects, even at relatively modest spends, take far longer than one year to conceptualise, design, obtain planning permission, raise finance and build out.

In order to really stimulate growth of investment in real estate (and the wider economy) throughout the UK, the Government need to give investors a clear timeframe in which they can implement their projects. Thereby we would really like to see a more sustained extension of say, three or five years that would facilitate a far greater range of projects to qualify for AIAs, allowing businesses to truly benefit from this fiscal incentive and grow their businesses in the longer term.

Further action

If you would like to discuss Annual Investment Allowances or wider Capital Allowances queries with one of our team, do get in touch as soon as possible. Early advice on any matter should provide an ability to discuss the most comprehensive options available in moving your project forward and achieving the optimal tax savings potentially available.

If you have any property tax issues please do get in touch for a no obligation discussion. You can phone the team on 0345 230 6450 or email healthcheck@e3consulting.co.uk.

Share this page

RSS

- This page can be found in the following news feeds:

- E3 Consulting News