- Planning Enforcement Changes to take effect from 25 April 2024 - LURA2023

- Finalist in 2024 Taxation Awards

- Spring Budget 2024

- Deadline looming for registration of Scottish property owners

- Nowhere to hide for Furnished Holiday Let owners

- 100% Full Expensing made permanent

- RICS CIL Index 2024 Announcement

- SPA Clay Shoot 2023

- We are exhibiting at UKREiiF 2023

- Welsh Freeports - The two winning bids are...

- Chancellor announces Full Expensing

- 100% Tax relief confirmed for two Scottish Green Freeports

- Making Your Furnished Holiday Lettings More Profitable

- Happy New Year 2023

- Second U-Turn in Urenco Chemplants Case – Court of Appeal Decision

- How Specialists help to Save through Property Tax

- E3 Consulting on the move in London

- Autumn Statement (November): impact on capital allowances

- December Roundtable - Community Infrastructure Levy & Land Remediation Tax Relief

- E3 goes to top with calls for planning re-think

- The Chancellor’s ‘Mini Budget’ – A Tax Bonfire!

- HM Queen Elizabeth II

- Gardiner v Hertsmere - Court of Appeal Judgment

- E3 Consulting's new main office in Wimborne

- Green light for Freeports

- Buried treasure?

- And the winner is...

- Cavernous divide in ‘plant’ arguments

- And the finalists are…

- E3 Consulting puts property tax on the radar

- Help E3 Consulting grow in a nurturing environment

- Spring Statement 2022 – Real Estate & Construction Update

- E3 joins the dots with Building People

- Property Marketing Awards 2022 – Celebrating 30 years of PMA

- Navigating choppy waters

- E3 helps GPs go green with trailblazing surgery

- CIL – New Research Lays Bare Planning Cost

- Webinar success as spotlight shines on Super-deduction

- CIL appeal win saves householder £22,000

- Business Analyst Flo joins E³

- Budget Day Autumn 2021

- Firing on all cylinders

- LRTR Boost your Tax Savings & Unlocking Toxic Land

- CIL by Numbers!

- Shining the legal spotlight on capital allowances

- UPDATE: 130% Super-deduction to be available for landlords

- Specialist speakers announced for CIL webinar panel discussion

- Happy 18th birthday…to us!

- Land remediation myths cleared up at conference

- E³ Consulting – 18th anniversary

- Tax Day 23 March 2021 … over hyped & under whelming!

- Super-deduction…super insight from E³ Consulting’s webinar

- Budget 2021 – Update – Super Deduction

- Budget 2021 Update – Significant tax breaks for freeports announced

- Budget – 2021 – Small Profit Corporation Tax Rate

- UK FREEPORTS - Will Tax Incentives Fulfil Their Purpose?

- E³ Consulting Support Minstead Trust’s Online Christmas Raffle

- E³ Consulting’s Autumn Property Tax Webinars

- £1m AIA Extension

- Alun Oliver becomes CEDR Accredited Mediator

- Property & Construction Update

- Community Infrastructure Levy (CIL) - New Year, new rules!

- Budget 2020 - Wish list for Eco friendly Buildings

- Todd Arnison joins YEP Southampton committee

- Welcome to our Winter update!

- RICS Community Infrastructure Levy Talks

- University Award for Apprentice Todd

- Toasting a Record Year for E3 Consulting

- It was 'Not Too Taxing' for the E3 Team at the SPA Clay Shoot

- Finalist in 2019 Accounting Excellence Awards - Specialist Team of the Year

- Finalist in 2019 Taxation Awards - Best Independent Tax Consultancy Firm

- Celebrating 15 Years in Style

- Consulting Boutiques: A Different Perspective on Consulting

- Studying Modern Languages: what skills do you gain and how are these relevant in work?

- It's all in the Mind

- Capital allowance changes consultation

- International Invasive Weed Conference

- Significant tax savings illuminated at London landmark

- So close for Todd in national award

- Taxing matters for property sector - Seminar 17 October 2018

- National award shortlist for apprentice Todd

- Three top tips for organising a fundraising event - and how these are relevant in business

- Alun takes seat on CLA regional board

- E3's Tax Trappers at it again at the SPA Clay Shoot

- Property Tax Update at Athelhampton House

- Welcome to our New Property Tax Surveyor

- Success at the JCI UK National Convention 2017

- RICS Q3 Market Survey Update

- Defeat for Taylor Wimpey on Builder's Block VAT Claim

- Non-Resident Landlords (NRL) to move into Corporation Tax Regime

- Joining JCI Southampton as a Corporate Partner

- Signatory to the RICS Inclusive Employer Quality Mark

- E3 Consulting Sponsors Hampshire Hot Shots!

- S.O.S.! Tackling the Housing Crisis, CIL and Build to Rent

- International Women's Day: Making a Commitment to Diversity and Equal Opportunities

- CPD Property Tax Talks

- Why E3 Consulting Employers Interns

- Re-joining the Dorset Chamber of Commerce & Industry

- Post Brexit View: Improvise, Adapt and Overcome!

- Welcoming New Interns to E3's Team

- Sponsorship of Alresford Town Football Club

- Finalist in 2015 Taxation Awards - Tax Consultancy Firm

- University of Warwick's Proactive Support of SME Businesses

- Property Taxation Specialist - Finalist in 2014 Taxation Awards

- VAT Specialist, Martin Scammell, Wins Indirect Tax Award

- Capital allowances claims using sampling for fixtures: HMRC Brief

- Deadline for VAT Relief on Listed Buildings

- Business Property Relief on FHLs

- Victory in the 9th annual Solent Property Tennis Tournament

- Industry Response to HMRC's Capital Allowances proposals

- Winning Partnership with Rose Bowl Plc

- E3 Consulting Wins at Taxation Awards 2011

- E3 Consulting Shortlisted for Lexis Nexis Taxation Awards 2011

- Change of VAT Rate

- Property Taxation Planning Opportunities - November 2010

- E3 Consulting Crowned Mixed Doubles Tennis Champions!

RICS Q3 Market Survey Update

The Royal Institute of Chartered Surveyors (RICS) recently released the results of their 2017 Q3 Commercial Property Market Survey at a breakfast event held at UBS’ new offices in London.

The Royal Institute of Chartered Surveyors (RICS) recently released the results of their 2017 Q3 Commercial Property Market Survey at a breakfast event held at UBS’ new offices in London. For those involved in the property sector, there are unlikely to be any major surprises, but there were a number of interesting titbits which can be gleaned from the data.

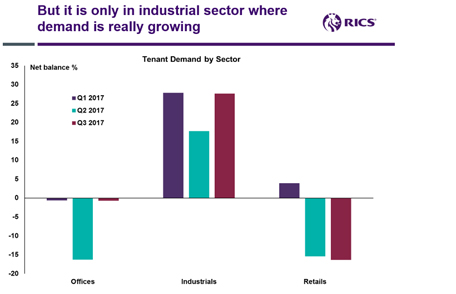

Tarrant Parsons, an economist from the RICS, presented the findings, highlighting some of the key trends. From an occupier point of view, tenant demand fell in the retail sector, continuing the trend of the decline in high street and the rise in online shopping. Office demand was stable, although tenants are now expecting more and more incentives to entice them into a new space.

However, the standout performer was the industrial sector. With the rise in ‘last mile’ delivery and increasing demand from online shopping, the industrial sector has been on the move for some time, with tenant demand rising strongly with a net balance of 28%. The strength of the performance here is underlined by a continued decline in incentives offered within the industrial sector.

Looking at investment, the picture is slightly rosier, with an increase in enquiries, including from overseas buyers, despite expectations of market uncertainty due to Brexit.

The industrial sector again outperformed the market, showing the strongest increase in investment enquiries.

Capital values echo the wider picture, but also display the difference between the primary and the secondary market, with secondary retail showing negative capital value expectations.

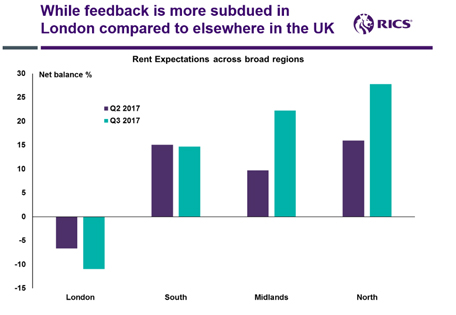

Geographically, the national view is positive all round; with good rent expectations and the majority seeing the market as fairly valued, with the only exception being London, which is taking a more cautious view. Although expectations in the capital remain flat, this is buoyed up by the industrial sector, with views for secondary retail and offices looking remarkably sanguine.

67% of respondents to the survey viewed Central London as being overpriced, and 73% felt that the market was in a downturn. Turning to the regional view, matters are much more positive, with the most prevalent view being that we are in the mid stage of an upturn in the market, and projections all round show an optimism.

Another focus of the event was risk management methodologies, which may well be included in future RICS Market Surveys.

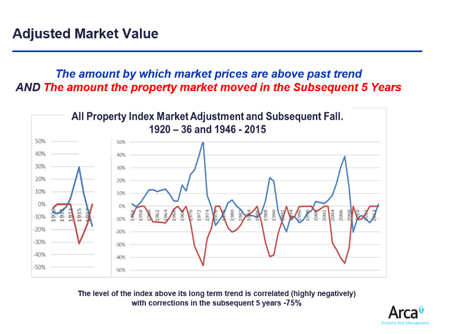

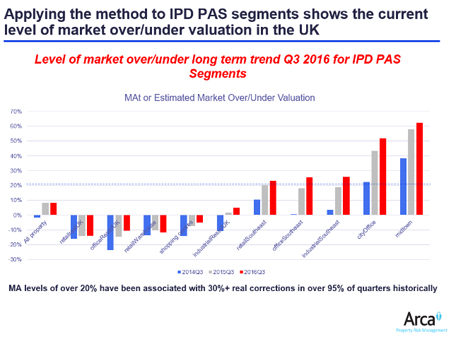

The methodology highlighted by Charles Ostroumoff of Arca Property Risk Management, was the Adjusted Market Value (AMV) method. Which compares current rates against the long term value, and identifies points where the market is overvalued and ready for a correction.

Looking at current market trends, the sector which stands out as overvalued is city offices, which the panellists agreed was at the peak of the market.

However, caution was urged when using this methodology, as it needs to be used in tandem with consideration of other factors, for example increased infrastructure in mid-town (between West End and the City) is leading to prices looking inflated but actually demonstrating long-term growth.

The final highlight was a panel discussion featuring Charles Ostroumoff, Jeremy Marsh of Schroders, William Hill of the Worshipful Company of Chartered Surveyors, Zachary Gauge of UBS Asset Management and Adam Alari of AXA Investment Management.

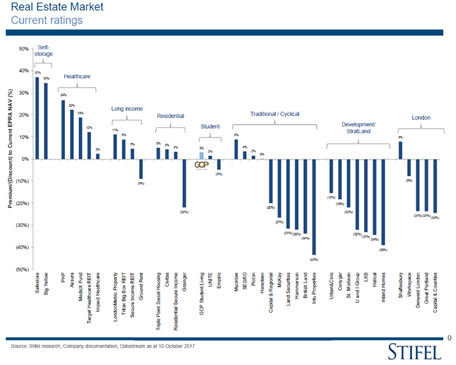

As well as discussing the AMV risk methodology, they also highlighted the emergence of the alternative asset class, along with the traditional retail, industrial and offices model. This includes things like healthcare, self-storage, student accommodation and B2R assets.

When compared to traditional investment funds, those specialising in these alternative asset classes are significantly outperforming, albeit generally at a lower level of overall capital employed. Although there is still caution surrounding some of these as an unknown quantity, investors are currently actively investigating these opportunities and it is expected that 15% of their investment will be in these alternative assets in the next 10 years.

The message of the morning, then, was one of overall optimism. While London seems slightly dour, there are very clearly opportunities if you look beyond traditional markets to the outer regions and alternative assets. For the savvy and adventurous investor, there remains plenty of scope for market activity and money to be made!

Share this page

RSS

- This page can be found in the following news feeds:

- E3 Consulting News